Anúncios

Santander All in One Credit Card

-

Annual Fee

Varies depending on the specific card variant.

-

Rewards rate

Typically offers cashback on purchases.

-

Intro offer

May have introductory offers on balance transfers or purchases.

-

Recommended Credit Score

Good to excellent credit score.

- Pros:

- Cashback on all purchases.

- No foreign transaction fees.

- 0% interest on balance transfers for a set period.

- Cons:

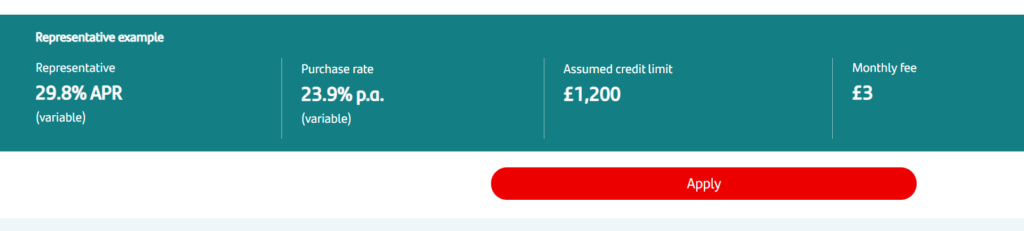

- Monthly fee.

- Balance transfer fee.

What do you think about credit cards that offer cash back? Well, you see, a credit card with cash back is not really uncommon; it shows up in every credit card application. Usually, it’s not prominently featured, but if you dig a little, you’ll find it. Sometimes, it’s even part of special conditions that activate the cash back.

I know of an amazing credit card that might be helpful for you if you’re looking for a card with this special quality. You might already know which credit card I’m talking about, and, of course, it’s the Santander All in One Credit Card. Don’t worry; I’m going to explain everything this credit card has to offer so that you can have the smoothest experience ever.

What are the requirements to request the Santander All in One Credit Card?

You know what the best way to learn more about a credit card is? It’s not just understanding its benefits and downsides. If you don’t know, it’s through the requirements and the necessary documents, which, coincidentally, are both topics I am going to discuss in this article. Now, if you are somewhat interested in this point, then keep reading with us.

Anúncios

- Must be 18 or older.

- Must have a good credit history.

- You must live in the UK permanently or have an income of £10,500 per year.

What are the necessary documents to request the Santander All in One Credit Card?

Finally, one of the last things you must know in order to apply for the Santander All in One Credit Card is the necessary documents. It’s not something urgent because you’ll obviously learn about the required documents when you are applying for it. Still, it’s always nice to avoid surprises, isn’t it? Either way, let’s take a look down below.

- Proof of income.

- Proof of residence.

- Identity.

Who should apply for the credit card Santander All in One Credit Card

Finally, the moment everyone has been waiting for—the star of this article is here. You may be wondering what I’m talking about. Well, it’s quite obvious from the name of this section. I’m referring to who should apply for the Santander All in One Credit Card. I am going to highlight the best profiles that can make the most of this credit card’s benefits. Let’s take a closer look.

Anúncios

Santander Clients:

Naturally, Santander clients are included in this group because, as with many credit cards, there tend to be additional benefits for individuals already associated with the bank. However, it’s important to note that being a Santander client is not a prerequisite for enjoying the features of this credit card. It’s merely an added perk that can enhance your experience.

If You Enjoy Cash Back:

If you’re a fan of cash back rewards, then this might be the perfect card for you. With this credit card, you can enjoy a 0.5% cash back on all your purchases. It’s worth mentioning that starting January 30, 2024, this credit card will no longer offer limitless accumulation of cash back monthly. After the 30th, be aware that the maximum cash back you can earn is £10 per month.

If You Want to Have More Cardholders:

This credit card isn’t just for you; it’s for your entire family. With this credit card, you won’t be limited to one or two additional cardholders—you can have up to three credit card holders at no extra cost. This makes it an excellent option for those who want to manage everything together under one company with a single credit card.

If You Dislike Interest on Purchases:

Are you someone who frequently makes purchases and dislikes dealing with interest charges? Well, this credit card has a solution for you. Upon opening an account with the company, you’ll enjoy a 15-month period of 0% interest on your purchases. It’s a pretty appealing offer, isn’t it?

One Piece of Advice for Those Wishing to Apply for the Santander All in One Credit Card:

Now that you’ve delved into two comprehensive articles about the Santander All in One Credit Card and all its features, you’re on your way to making an informed decision that aligns with your unique needs. As a token of appreciation, here’s a valuable tip for when you decide to apply.

My advice for today is: please check thoroughly before submitting your application for this credit card. It’s crucial to do your due diligence because neglecting to do so can have a significant impact on your credit score. A rejection can lower your score, and that’s something none of us want. We’re all rooting for you to achieve the best credit score possible.

Is the Santander All in One Credit Card Truly Worth It? Let’s Compare the Pros and Cons.

Now, let’s delve deeper into the question: Is the Santander All in One Credit Card genuinely worthwhile? Can you apply for it and find genuine satisfaction in its use? Without a doubt, I can assure you that the answer is a resounding yes. This credit card offers much more than just its standard features. While the presence of an annual fee may be perceived as a drawback for some, I encourage you to look beyond this aspect.

Upon closer inspection, you’ll uncover a world of benefits that have the potential to exceed your initial expectations. From cashback rewards to the convenience of multiple cardholders at no extra cost, the Santander All in One Credit Card is designed to enhance your financial experience. It’s an investment in financial convenience that extends beyond the surface, making it a valuable addition to your wallet.

Ready to experience it for yourself? Apply now for the Santander All in One Credit Card.

The application process for the Santander All in One Credit Card couldn’t be easier. Whether you’re a seasoned credit card applicant or a first-timer, navigating through the application is designed to be user-friendly and straightforward.

If, at any point, you find yourself with doubts or require assistance throughout the application process, we’ve got you covered. Simply click on the link provided below to access additional information and resources. Our dedicated support team is also available to assist you, ensuring a seamless and hassle-free application experience.

Apply with confidence and take the first step toward unlocking the benefits of the Santander All in One Credit Card. Click the link now to learn more and start your journey to financial convenience.