Anúncios

Amazon Business American Express Card

-

Annual Fee

Varies depending on the specific card variant.

-

Rewards rate

Offers rewards or cashback on Amazon purchases and business-related expenses.

-

Intro offer

May have introductory offers or rewards for new cardholders.

-

Recommended Credit Score

Good to excellent credit score.

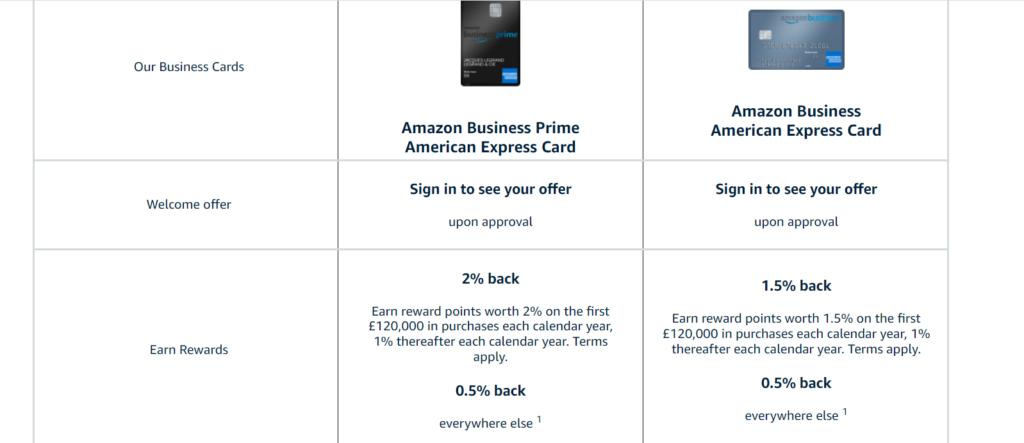

The Card for small business owners

2% back or 90 days extended payment term on each UK purchase at Amazon Business, Amazon.co.uk and Whole Foods Market, with an eligible Business Prime membership.

OR

1.5% back or 60 days extended payment term on each UK purchase at Amazon Business, Amazon.co.uk and Whole Foods Market, for all other Amazon customers.

- Pros:

- Rewards on Amazon purchases.

- No annual fee.

- Additional cards for employees at no extra cost.

- Cons:

- Rewards mainly beneficial for frequent Amazon shoppers.

- Higher APR on purchases.

Do you know what the Amazon store is? Well, if you don’t, the Amazon store is a vast online platform that caters to virtually every need. It offers a wide array of products, including electronics, furniture, and various other items. Amazon has become a go-to destination for online shopping, providing convenience and an extensive range of high-quality products.

Anúncios

The specific credit card I am referring to is the Amazon Business American Express Card. If you’re seeking a credit card that not only facilitates purchases within the Amazon store but also offers cash back and other remarkable benefits, then this card is worth considering. However, before you apply, it’s essential to have some information about it, and I am here to provide you with all the details you need.

What are the requirements to request the Amazon Business American Express Card?

Certainly, you will need to adhere to specific requirements to apply for this credit card. If the process were too lenient, it could lead to widespread accessibility, potentially allowing individuals without sufficient financial knowledge to obtain the card. Let’s examine the necessary requirements for application.

Anúncios

- The business must have a current UK Bank or Building Society account.

- Be 18 years of age or older.

- Acknowledge the requirement to pay the annual fee of £50 (fee waived for the first year).

- Be a UK resident.

What are the necessary documents to request the Amazon Business American Express Card?

As I’ve mentioned before, every credit card application requires specific documents to be submitted. When initiating the application process, you will be required to provide personal information. However, the company cannot verify the accuracy of this information solely based on your input. To validate the details provided, they need supporting documents. Let’s explore the documents you will need to submit along with your application.

- Identity verification documents.

- Proof of residence.

- Proof of income.

Who should apply for the credit card?

Certainly, you may already be aware that each credit card is tailored to suit a specific profile or group of individuals who can benefit more from its features. While you can still apply for this credit card without necessarily belonging to any of the groups I’m about to mention, it is advantageous if you fall into one of these categories.

People who like to buy things:

This is one of the primary groups, and it holds significant importance. If you enjoy making purchases, this credit card is an excellent choice. It offers a 60-day grace period to pay for your purchases. This means that when you buy something, you have the flexibility to delay payment, allowing you up to 60 days to settle the amount.

Amazon enthusiasts:

Another noteworthy group comprises those who frequently make purchases on Amazon. If you are an avid Amazon shopper, this credit card is tailor-made for you. While it is still possible to apply for and benefit from the card without being a regular Amazon customer, the card’s advantages are particularly well-suited for those who frequently shop on the platform.

American Express clients:

If you are already a client of the American Express company, you fall into another group that can derive additional benefits from this card. Existing clients of American Express often enjoy perks such as higher credit limits, enhancing the overall advantages of the Amazon Business American Express Card.

Those who enjoy cash back:

The final profile that stands to benefit significantly from this credit card includes individuals who appreciate cash back. Given that this credit card is affiliated with Amazon, you will receive a percentage of cash back on your Amazon purchases. It’s worth noting that even for non-Amazon purchases, a lower cash back percentage is applicable, making it a worthwhile choice for those who appreciate cash back rewards.

One piece of advice for those wishing to apply for the credit card:

A simple yet crucial piece of advice for anyone considering applying for this credit card is to conduct thorough research. Given that this is an Amazon credit card, it might be tempting to assume that it offers only the standard benefits associated with such cards. However, delving deeper into its features might reveal additional advantages.

Before I researched this credit card, I assumed it was just like any other card. However, upon discovering that it provides benefits beyond the Amazon store, I realized its potential usefulness for a broader audience, even for those who don’t frequently shop on Amazon.

Furthermore, consider reaching out directly to American Express. Engaging in direct communication with the company can provide you with insights and a deeper understanding of the credit card’s specific benefits, especially those related to the Amazon affiliation. The company representatives are likely to have comprehensive knowledge that goes beyond what I can provide.

Is this card really worth it? Let’s compare the pros and cons.

After carefully evaluating the features and drawbacks, I believe this card is indeed worth considering, but it comes with a significant condition. Its worthiness is primarily dependent on your usage of the Amazon store. If you are an occasional or frequent user of the Amazon store, then the benefits offered by this card make it a valuable choice.

However, if you rarely or never make purchases on Amazon, the card may not provide substantial advantages for you. Taking this condition into account, if you are an Amazon shopper, I highly recommend applying for the Amazon Business American Express Card. It offers a range of benefits that can enhance your overall shopping and financial experience.

Apply for it now!

To delve deeper into the advantages that the Amazon Business American Express Card can bring to your financial life, I strongly encourage you to take the next step and begin the application process promptly. Applying now not only sets you on the path to potentially securing the card but also allows you to expedite the timeline for experiencing the various perks and benefits associated with it.

Don’t miss out on the potential benefits—apply for the Amazon Business American Express Card now and unlock a world of financial advantages tailored to enhance your shopping experience, especially if you are a frequent patron of the Amazon store.